Mood:

Topic: Website

Trying out new host with root access, pretty secure.

http://www.randcamengine.com

I am using Drupal and OpenPublish.

For the Blog I am using Wordpress.

So be patient as I transfer old stuff and put on new stuff.

Dale

| « | October 2018 | » | ||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 31 | |||

Trying out new host with root access, pretty secure.

http://www.randcamengine.com

I am using Drupal and OpenPublish.

For the Blog I am using Wordpress.

So be patient as I transfer old stuff and put on new stuff.

Dale

Reg Technologies Inc.'s "revolutionary" rotary engine has been running on hot air for more than two decades.

The hot air has been provided by John G. Robertson, president and controlling shareholder of the Richmond-based company, which trades on the TSX Venture Exchange.

Since 1988, Robertson has been pitching his engine technology for everything from weed trimmers to military jet engines.

"The building of the Rand cam-engine has commenced and will be completed in less than 90 days," he said in a July 1988 release.

Nothing came of that.

"The final assembling and testing of the Rand cam-engine is nearing completion," he said in December 1990.

Nothing came of that.

"Reg and a Fortune 500 company -- a major defense contractor involved in aerospace and military work for the department of defense in the U.S. -- are negotiating a joint development license . . . primarily for defense applications," he said in October 1993.

Nothing came of that, either.

In 1994, Robertson set up a U.S. subsidiary, REGI U.S. Inc., which would pay for 50 per cent of development costs in exchange for U.S. rights to the technology. (The stock trades on the OTC Bulletin Board in the United States.)

Robertson hired a variety of investor relations firms and newsletter writers to hype the stock of both companies.

"After years of intensive research and development, REGI U.S. Inc. is in the final testing stages prior to actual manufacture and/or licensing of its revolutionary rotary engine," the Bull & Bear Financial Report trumpeted in January 2006.

In January 2007, the newsletter noted Khandaker Partners of New York had set a target price of $13.73 US for REGI stock during the next 18 to 24 months.

The newsletter described Khandaker as an "independent research and advisory firm," but in fact, REGI paid the firm to prepare the report, which explains its ridiculously bullish forecast. (The stock, which was trading at just over $1, has since slumped to 25 cents.)

Now 68, Robertson is still engaged in this dance of the seven veils. Just last week, he reported that Reg and REGI "are pleased to announce the release of drawings to start fabrication of a RadMax engine test rig."

"It's the penny stock promotion that never quits," says John Woods, editor of Canada Stockwatch, a Vancouver-based stock information service.

"Penny stocks usually have a life cycle of one to five years, not one to five decades."

All of this would be quite funny, except that it's costing shareholders a lot of money.

Neither Reg nor REGI has generated a cent of revenue. Reg's cumulative losses now exceed $14 million and REGI's are approaching $12 million US.

Furthermore, financial statements show these companies are not serious about developing the engine. During the past two fiscal years and the first three quarters of this year, Reg spent only $581,000 on research and development. During this same period, it spent $3.6 million on general and administrative expenses.

REGI similarly spent only $338,000 on R&D while spending $2.9 million on general and administrative expenses.

Robertson runs two other public companies out of his office that follow the same pattern.

Linux Gold Corp., a TSXV exploration company, has burned through more than $15 million in capital but has not generated any revenues and the book value of its assets is now less than $140,000.

Where does all the money go? During the nine months ending Nov. 2008, Linux's total expenses were $458,000, but only $61,702 of that amount was spent on exploration. Most was used for administration, including $102,971 on travel and promotion.

Ditto for Teryl Resources Corp., a TSXV oil and gas company. During the same nine-month period, it generated only $14,985 in revenue while spending $78,934 in management and directors fees; $15,565 in travel, auto and entertainment; and $86,218 in publicity, promotion and investor relations. Its cumulative losses now exceed $9.4 million.

Neither Robertson nor his wife, Suzanne (who serves as a director of Reg, Linux and Teryl) draw salaries, but their private company, SMR Investments Ltd., charges each of the four companies $2,500 per month for management services, which adds up to $120,000 per year.

Reg, Linux and Teryl also pay them rent at a marked-up price, as well as directors' fees and expenses, which, judging by the amount spent on travel and entertainment, are liberal.

And of course, they get lots of stock options.

With these business flops providing such a comfortable living, it's no wonder Robertson was not happy to hear my voice.

"It's been a challenging ordeal, and we are finally making it a success and you are coming around to destroy it," he said, referring to the rotary engine that could, but won't.

"For us to be going this far, we should be getting a medal."

dbaines@vancouversun.com

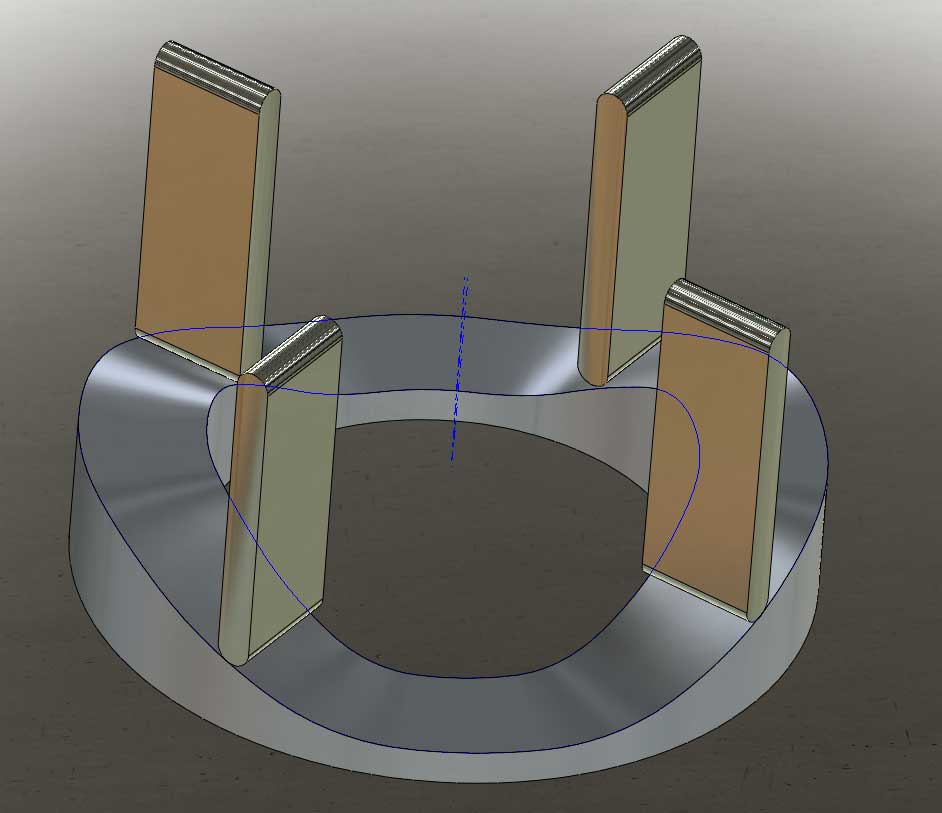

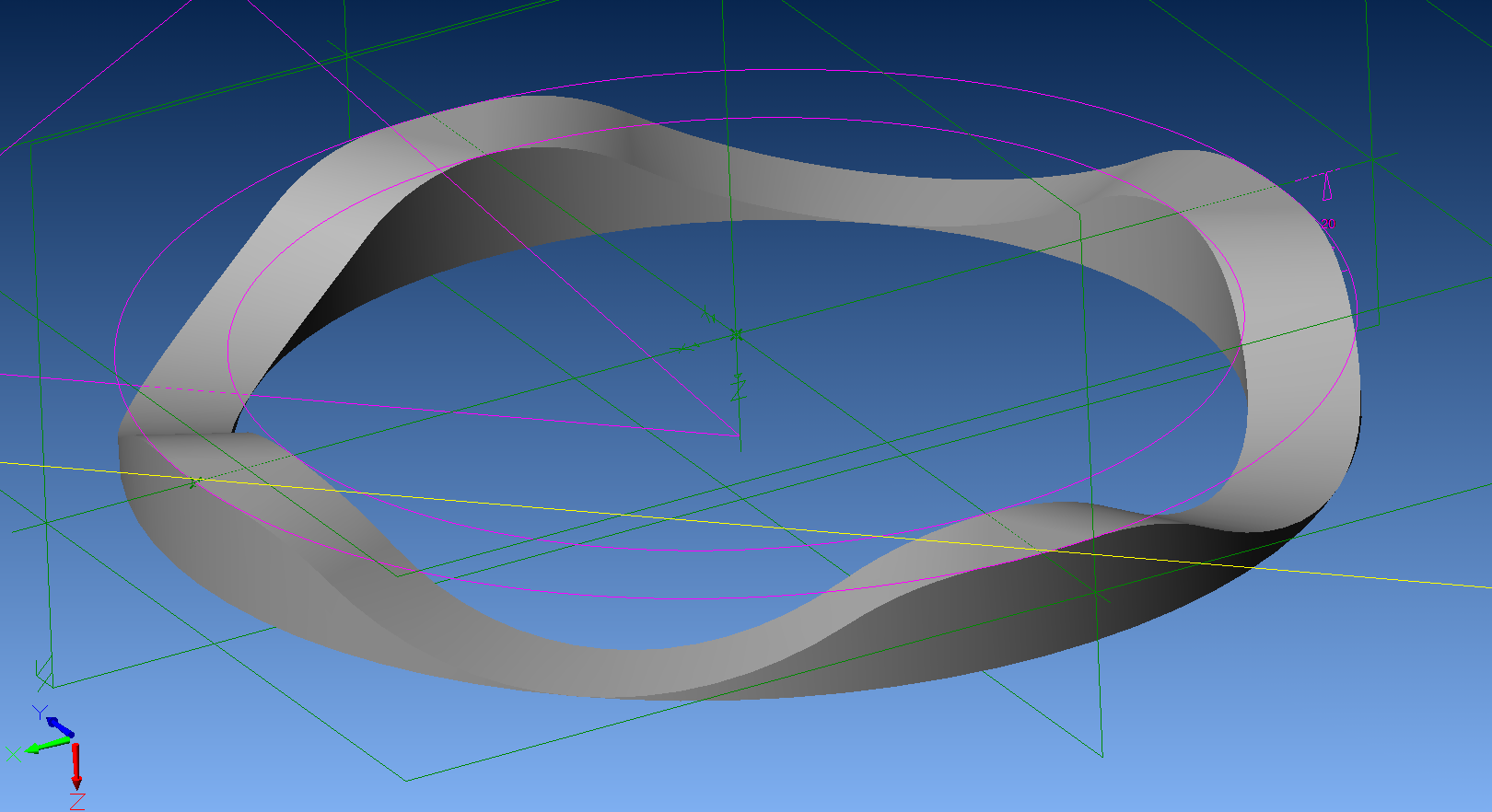

The main reason for the two vane design was to overcome the static inertia of the air mixture. In piston designs the air gap in the combustion chamber reduces volumetric efficiency and they dont get reasonably efficient until high rpm.

A four vane solution variant would have 45 degrees of overlap. The 3 vane version would have 15. Overlap is when the engine begins to work against itself thus reducing efficiency.

In engineering design one of the key steps is finding as many solution variants as possible to provide a complete picture of the design space.

The original patented design was for 2 Vanes and was optimized for diesel fuel at low rpm.

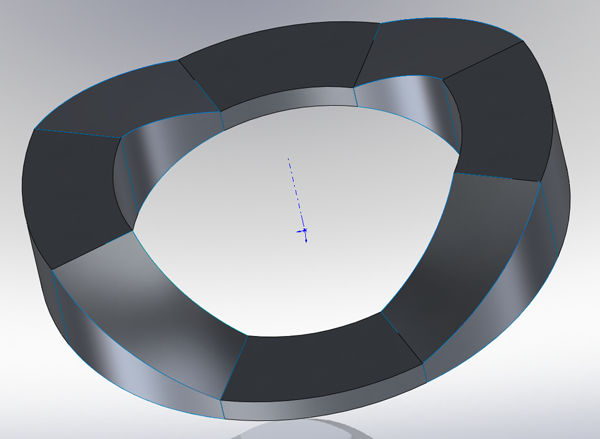

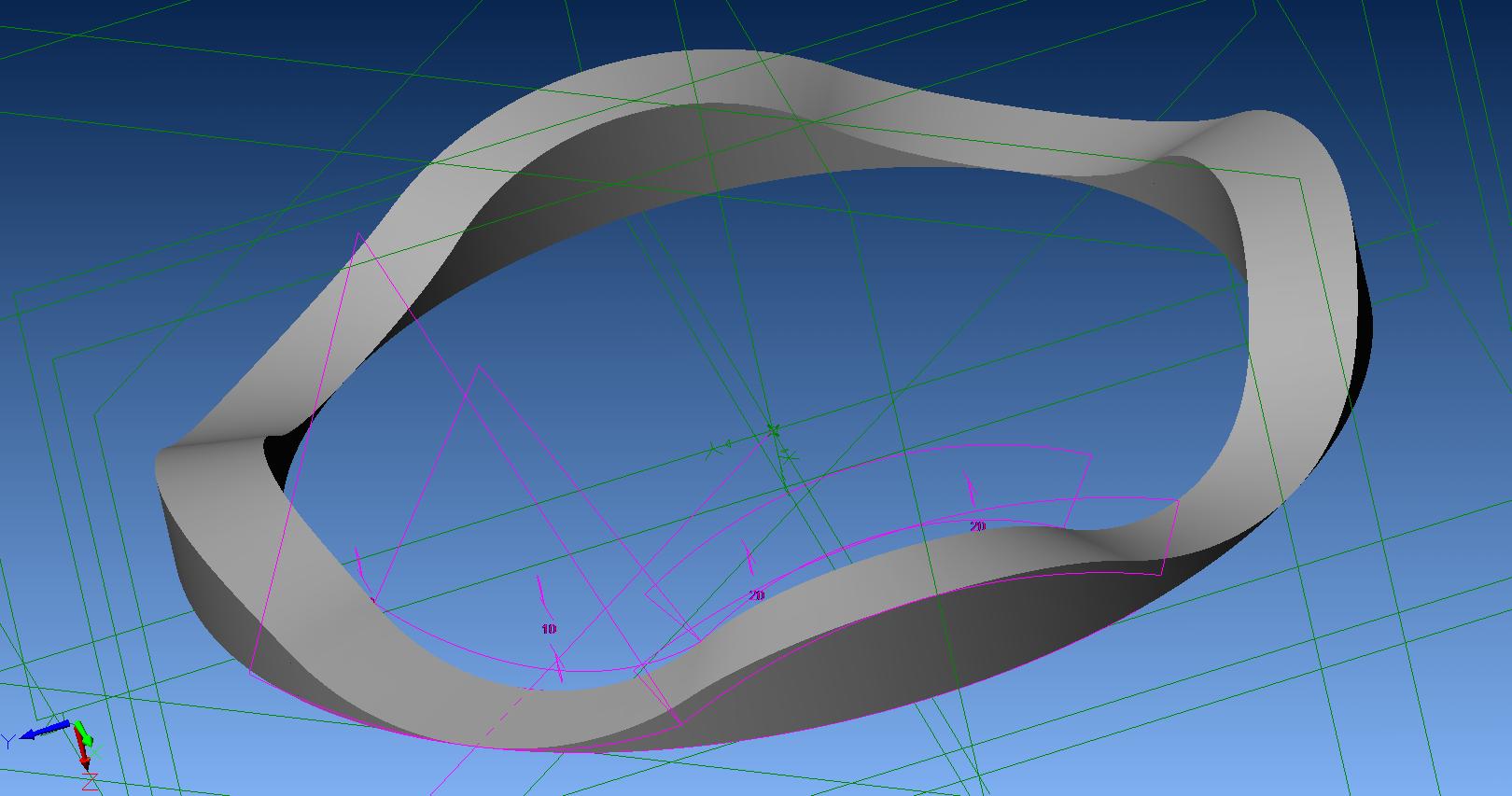

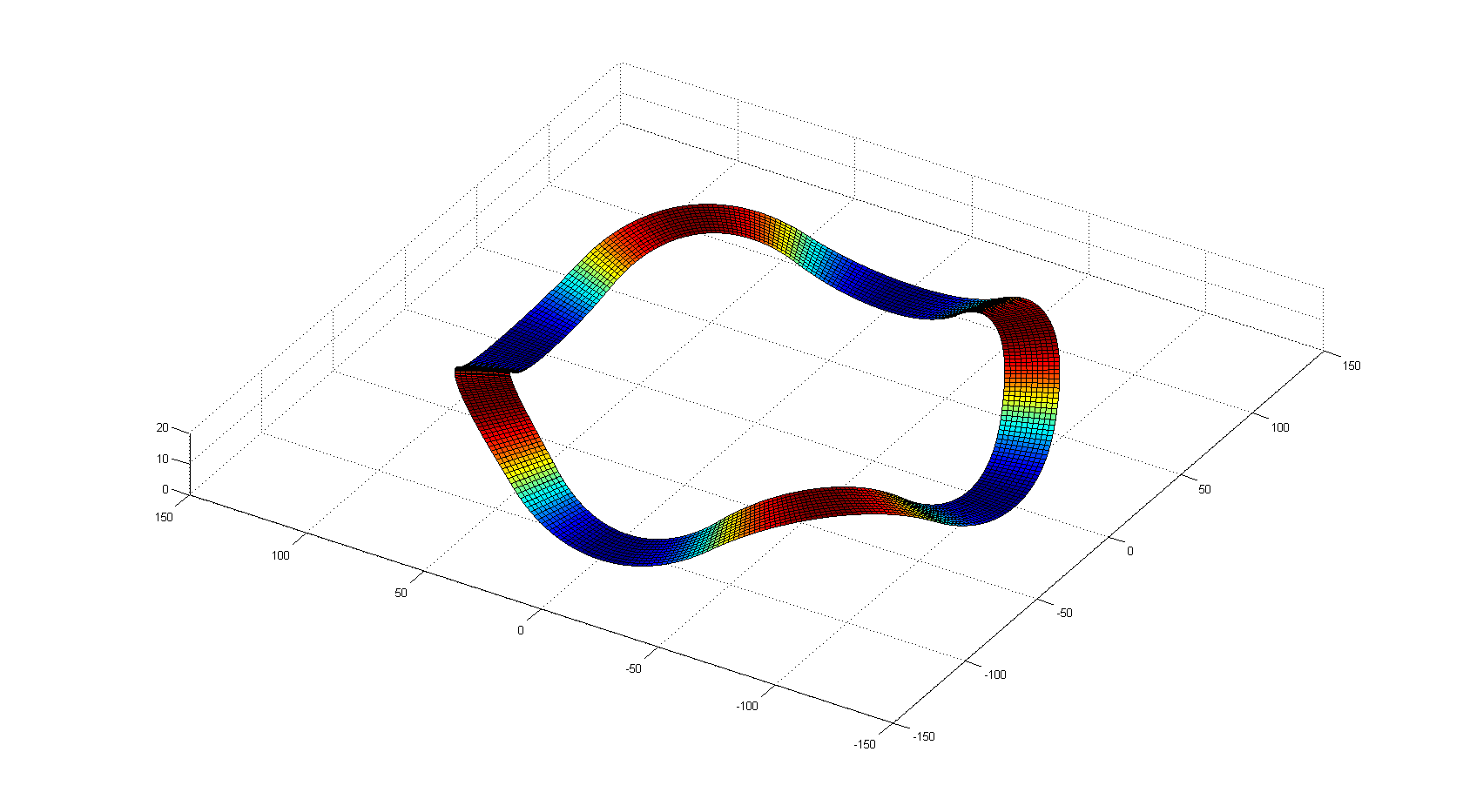

This is a 3 vane solution variant.

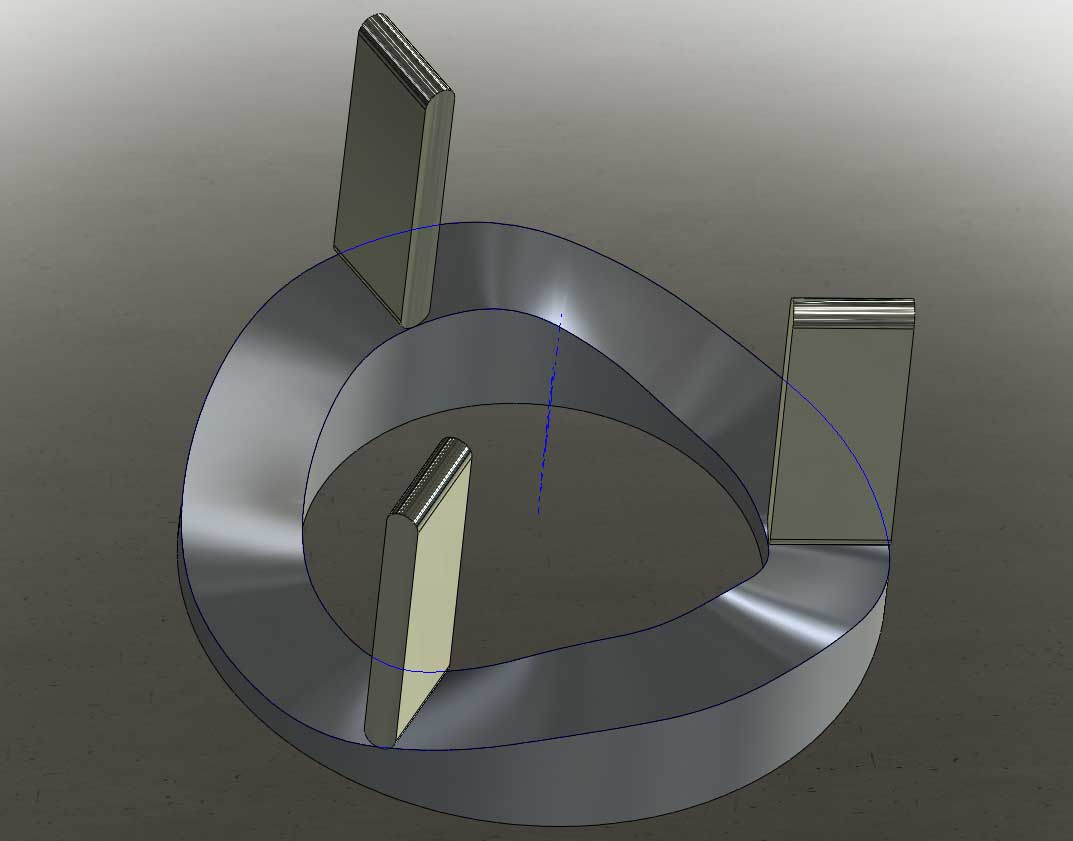

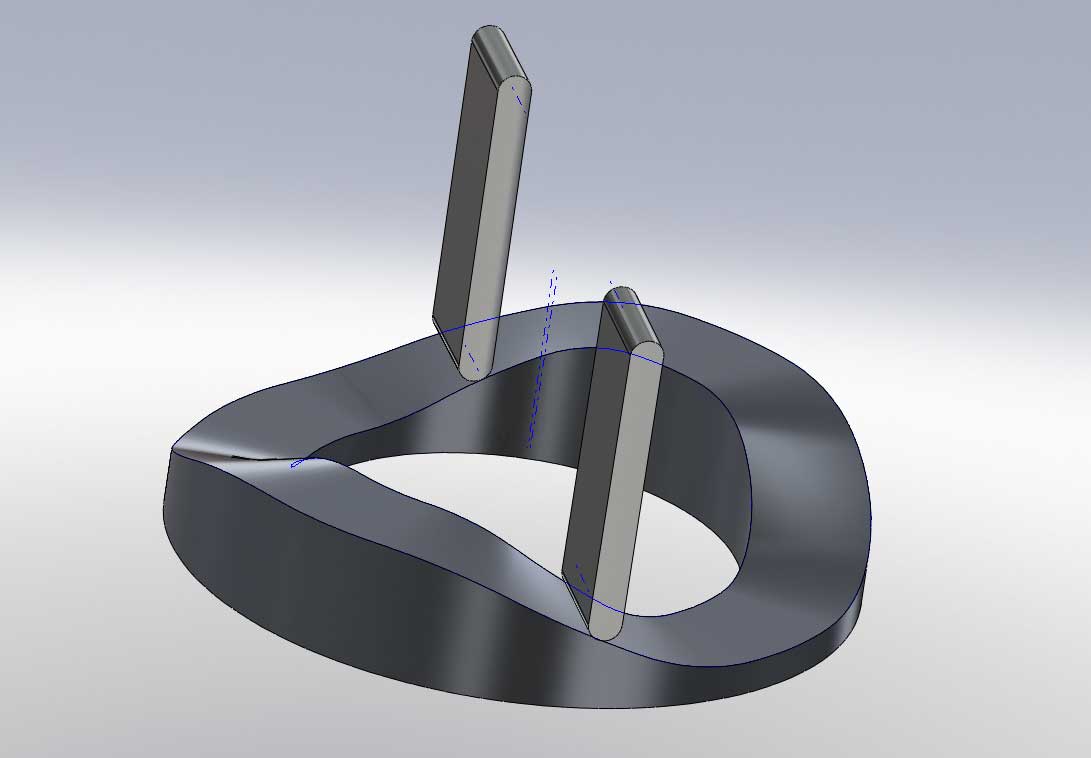

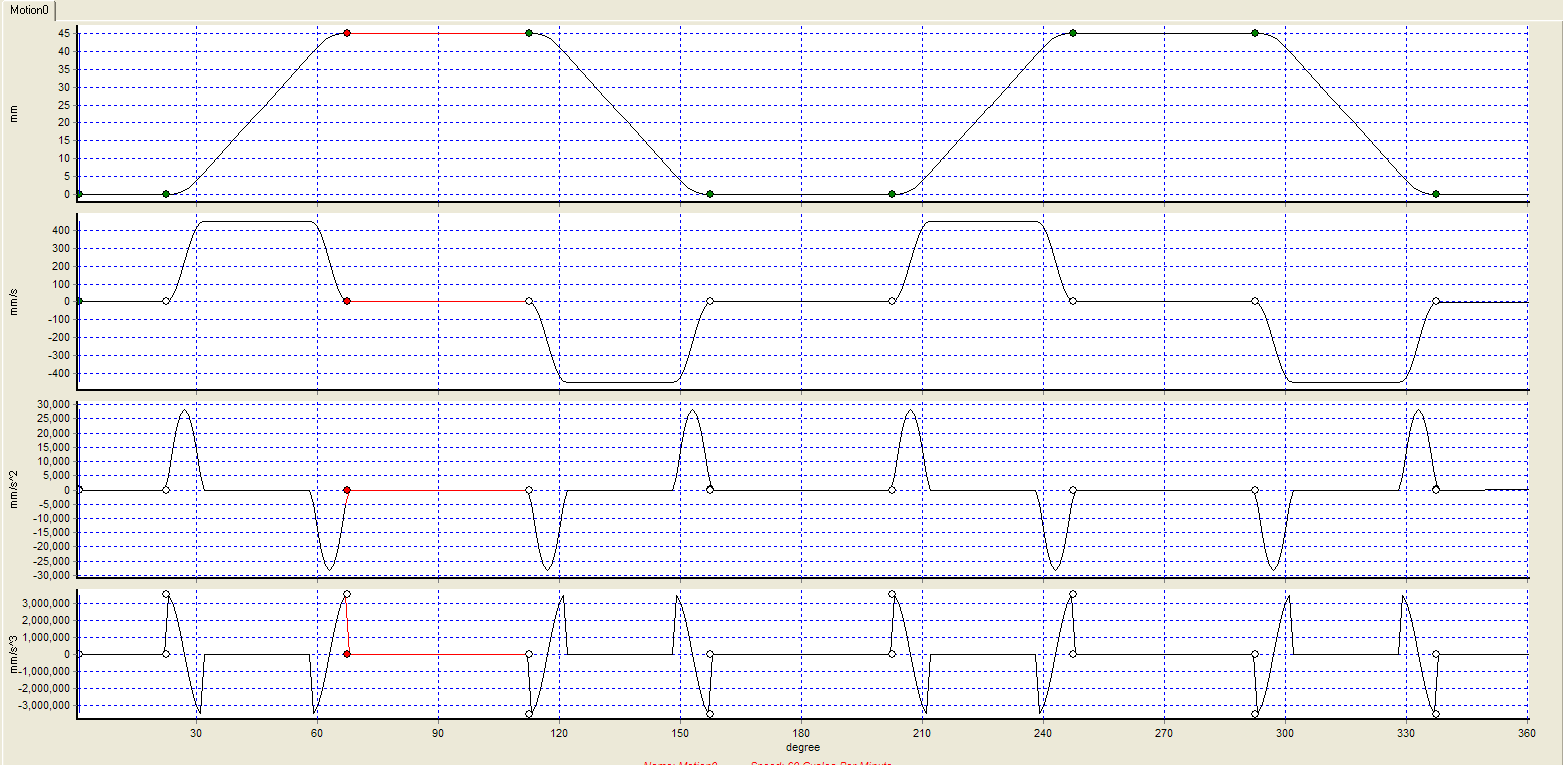

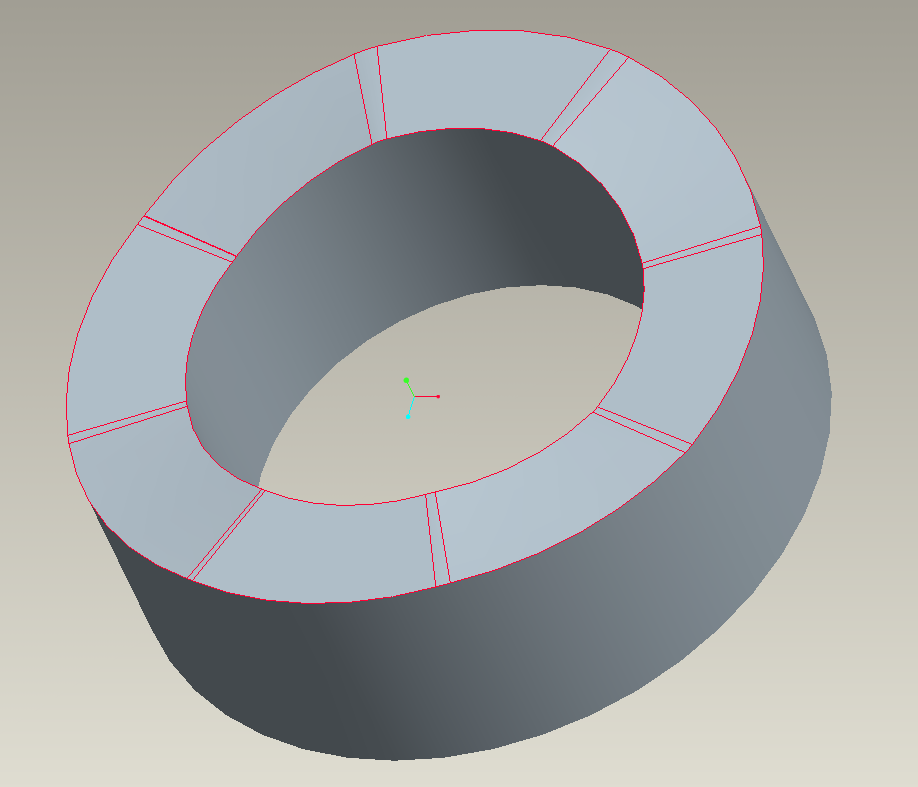

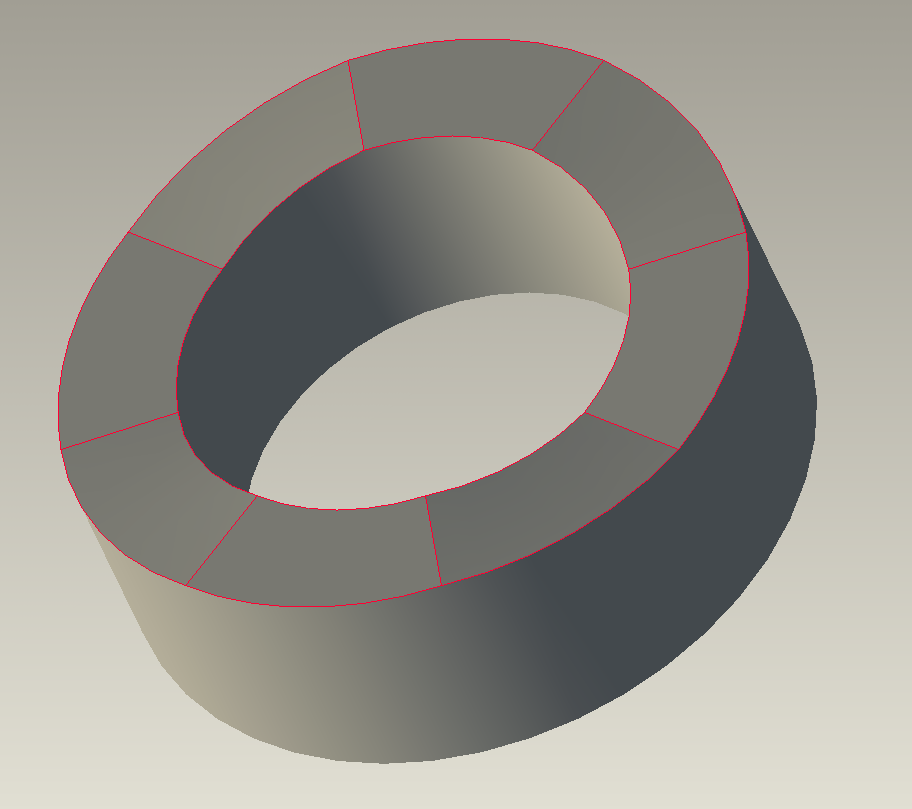

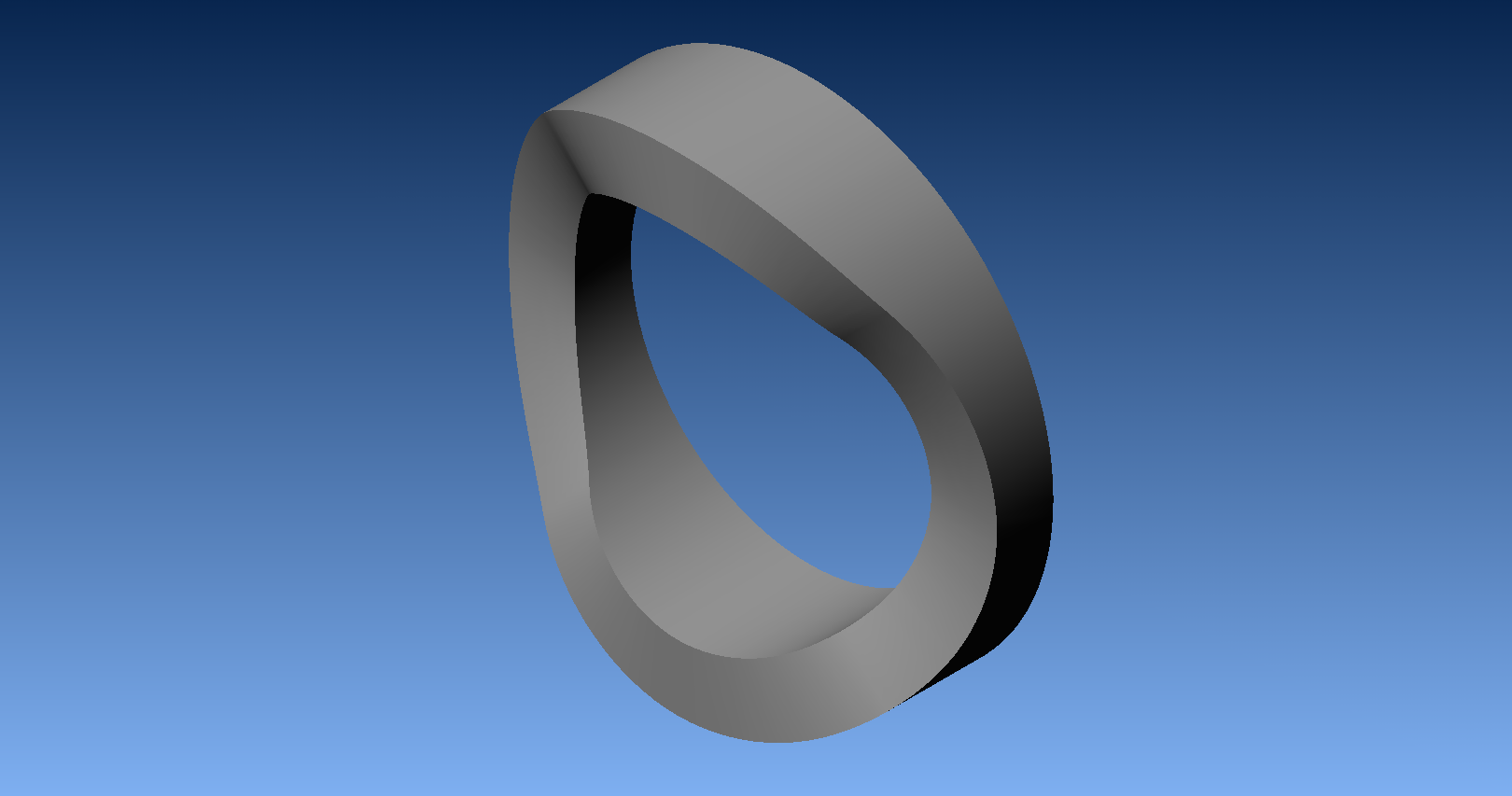

Finally got the cam to a true solid in Solidworks. I worked everything out to a tenth of a degree. So the number of xyz coordinates was over 3600. Pushing the limits of poor excel.

Wheww 16 hours later... :) be nice to get some training in Solidworks or ProEngineer. I found a way to program mulitple engine sizes but have to learn the macro programming language for its parametric capabilities.

Found a good program that calculates important values for the proper cam profile design

Notice how steep acceleration and jerk are at only 60 rpm. Contrary to popular belief sinusoidal profiles are not the best profiles...:)

* I couldnt get a true constant velocity their are little transitions so it looks like the solution that I provided Jim. I am gonna try plug in my profile to see if it get reasonable results.

This latest version of Solidworks is way better than the earlier version. I was able to export the double heilix curve out of Excel.

I am gonna try out both Pro/Engineer and Solidworks. My main goal is to model the motion of the vanes and calculate the various parameters.

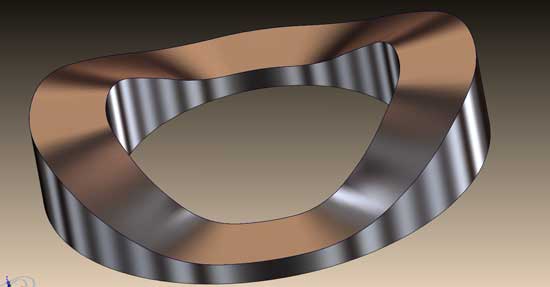

This is a rough draft of the the second generation cam illustrating how the transition area was not enough.

There are a number of mathematical areas that have to be geometrically proven. It is a given that there is a double helix spiral. But there is another geometric feature that has to be proven. On top of that there is two other geometric features on top of that. All of a sudden we are getting into multi dimensional problems.

When I asked Jim how do you verify if the program works? He said all you have to do is put the two cams together and see if there is any gaps. I knew it was geometrically correct because I never failed to provide my high school geometry teacher the correct proof of any challenge geometry problem. I thought that was worth at least an A...but all he gave me was a B.... :)

I had a good look at Radians cam profile and seems to me they are trying that sinusoidal cam profile.

But it does look like their is some flat spots and thus is more of a modified version of my cam profile. I can tell you right away that there is something wrong because the angles appear to steep for the intended rpm.

Shopping around for CAD/CAM/CAE software. I was impressed on how ProEngineer was able to model the original cam profile. I may do a simulation on the infinite acceleration but we already know that this version did not work.

MOLLER INTERNATIONAL ACHIEVES BREAKTHROUGH IN ROTARY ENGINE PERFORMANCE

These guys are on the right track. This is a summary of the press release;

Davis, CA, May 14, 2008 – Moller International (OTC-BB: MLER) announced today that it has achieved a major breakthrough in rotary engine performance. A version of the Company’s Rotapower® engine is designed in such a way that the engine’s two rotors operate in series rather than parallel. This design allows the first compressor/expansion rotor to supercharge the second power rotor while the exhaust from the power rotor is further expanded in the compressor/expansion rotor, extracting additional power. In effect, the engine operates in what is termed a compound cycle. Because of the additional energy captured from the exhaust gases, engine noise is reduced by 93% and exhaust temperature is reduced by 47%. Moller International’s non-compounded Rotapower® rotary engine has already demonstrated a fuel consumption 12% below that of the new Mazda Renesis rotary engine. Compounding is expected reduce the Rotapower® engine’s fuel consumption by an additional 25%.

The Wankel still suffers from a geometry problem that is similar to the piston engine and it would be difficult to over come with super charging or turbo charging. However the compounding effect is a step in the right direction. My version has this effect but it does not need the exhaust recirculation. This wasted exhaust is from the bad geometry and to get rid of the waste the geometry has to be changd.

Bah Humbug....

I hate this time of the year

I was leafing through the press releases and came across the Regtech announcement of the hiring of Paul L Porter as Chief Engineer. I guess the other one couldn't deliver the goods.

Rob from Radian is high on him stating Paul has "tremendous metal seal expertise"...

It took Mazda $17 million in 1970 dollars to complete the Wankel engine and it was the seals that gave them the most problem. Even today if you look at the primary cause of Mazda Wankel failures - apex seals.

Of course Mazda was using the Edison development methodology, ie try every available material and go through them one at a time.

Jim used low quality iron in Pakistan, higher quality iron in Canada, RadMax used M2 Tool Steel for the seals and all failed. M2 Tool Steel is awesome material and can't understand how that didn't work...:)

I tend to take the Tesla approach and simulate the invention in the mind and when you build it, viola it runs the first time around. The brain is most powerful computer on the planet and I would put money on it instead of the high priced computer aided engineering software such as COSMOS. (Paul is going to use it) And I am not a betting man, I only put money on a sure thing. Bet the ranch baby...![]()

| Radian MILPARTS P/N: 10321 Name: Vane Seal Description: Seals Between Rotor and Vane Material: M2 Tool Steel Mat’l Spec: ASTM A597 Dimensions: 1.60 x 0.099 Unit Weight: 0.004 lb. Quantity/Assembly: 48 |  |  |

Radian Vane Seals

| Radian MILPARTS P/N: 10311 Name: Vane Description: Axially Movable Plates Material: M2 Tool Steel Mat’l Spec: ASTM A597 Dimensions: 2.270 x 0.25 Unit Weight: 0.37 lb. Quantity/Assembly: 12 |  |  |

Radian Vanes

This is what happens when you put a technical geek in charge of Web Development. But thats alright I am one myself.

I had a close look at their technical strategy and give them a 25 percent chance of success.

They are on the right track and have advanced a step in the right direction but still 8 steps behind me :)

Decided to down grade chance of success after doing some research into the HERE version that they are high on.

By focusing on Heat they are just like any ol school or even new school engineers. A gasoline piston engine has converted 80 percent of its potential energy to heat and work before it reaches 10 degrees after top dead center (TDC). Most is converted to heat as the mechanical advantage is not to great near TDC.

It is sorta like we have been down this road before developing the Turbine Engine. A turbine engine has very bad fuel consumption, I was watching a show on Discovery Channel and it mentioned that a big jet can burn as much as 45 gallons per minute. A turbine engine converts almost 100 percent of its potential energy to heat before it starts to produce useful work.

So I would say it has less than a 10 percent chance of success. Lucky only Uncle Sam could afford to develop technology like this.

With the rise of gasoline to almost 7 dollars a gallon in my home town it won't take long for consumers to demand more fuel efficient vehicles. Also Governments will have to legislate in manditory fuel efficiency.

I set a time table in my mind that once fuel hit 10 dollars a gallon I will be able to raise the necessary capital to build my version of the RCE.

Update: even though the price of fuel came down recently, it was only because the Americans dropped their driving by 30 percent in response to the high prices. In my home town it is still 6.67 a gallon and is affecting the food prices all round.

Unless Uncle Sam legislates mandatory efficiency it is still business as usual...

Formula Student Alternative Energy Class 1A

www.formulastudent.com

Engine size = 250cc or 15.25 CIDTurbo or Supercharging permitted

Estimated Power

@ 1 HP/CID = 15

@ 2 HP/CID = 30

@ 3 HP/CID = 45 (Current Maximum for Production Engines)

@ 5.5 HP/CID = 84 (Current F1 Power to displacement ratio)

I refined the model and just have to verify it on a CAM program. I also have some new books on Kinematics and Dynamics so I have some bedtime reading to do :)

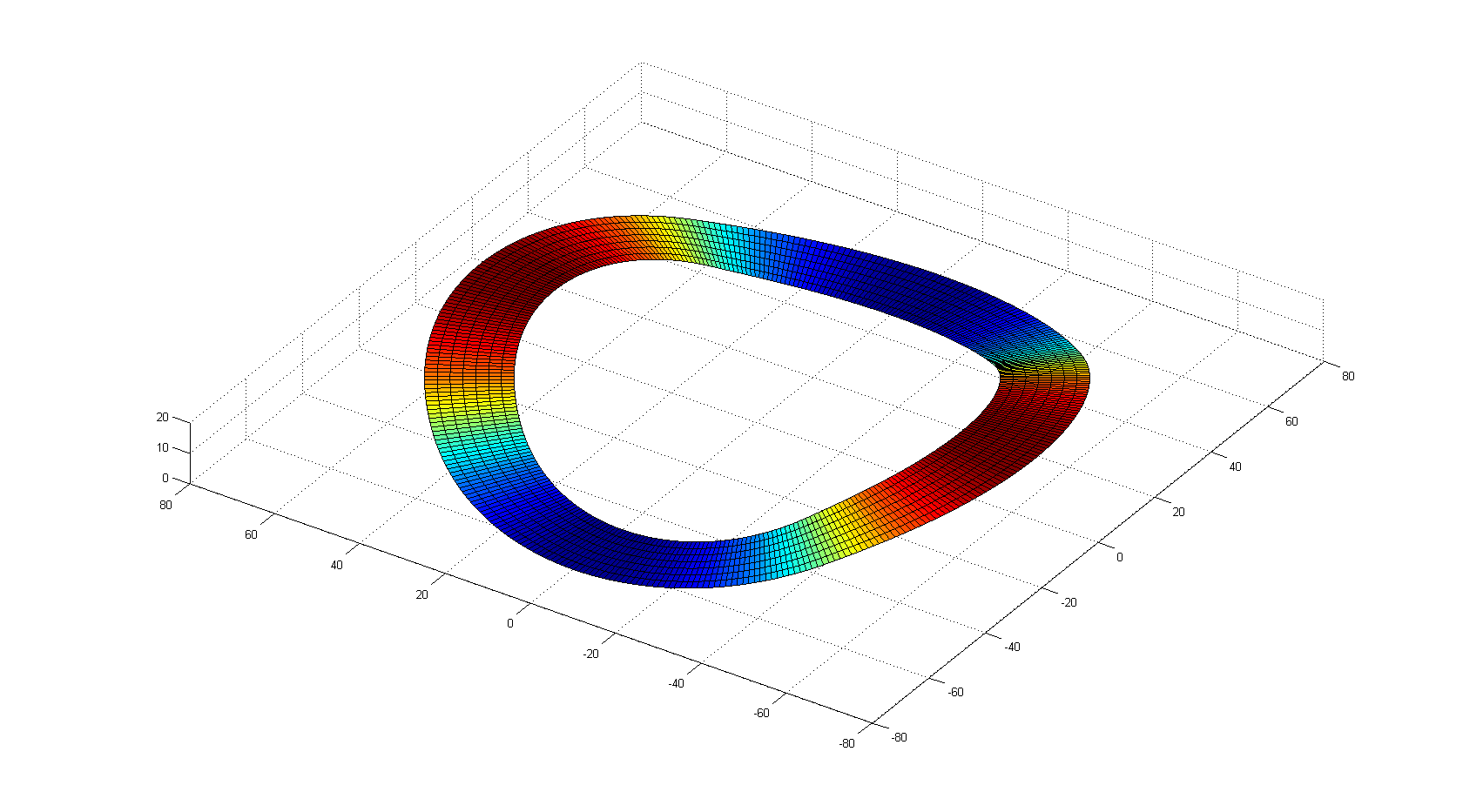

Was teaching myself Matlab the language of geek technical computing. After 5 hours of fooling around I came up with this plot.

I verified the geometry myself and would need to find engineer bright enough to verify my work.... :)

Newer | Latest | Older